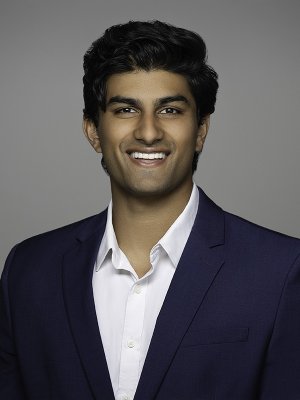

Lisa has over twenty years of tax and accounting experience, working primarily for Durbin Bennett as a Tax Advisor. Her primary focus is partnerships, corporations, and trusts. She also works with individuals and some private foundations. She currently assists Durbin Bennett on a flex-time basis and spends her personal time focusing on family and community service endeavors. Lisa first joined the firm in November of 1998.

Prior to joining Durbin Bennett, Lisa has worked for Clear Channel Communications as a Tax Senior handling all State and Federal tax compliance reporting for the Broadcast segment’s parent corporation and several hundred subsidiaries. Lisa also worked for St. David’s Healthcare Partnership in Austin, where she assisted with audit and tax compliance work and was responsible for all general ledger account activity, including monthly and yearly closing entries and reconciling and tracking patient days and employee hours.

Lisa holds a Bachelor of Business Administration in Accounting from Texas State University. She is the President of the Board of Trustees for Calvary Episcopal School in her hometown of Bastrop, Texas.